Satcom Direct (SD), the AI-powered spend management platform MySky, and tax reclamation experts, VAT IT USA, have entered into a strategic alliance to streamline VAT and tax reclamation to mutual customers...

Read More

The US Bankruptcy Court for the Eastern District of Virginia, Richmond Division, has approved Intelsat’s Plan of Reorganization, marking the final Court milestone in the Company’s financial restructuring process. Intelsat...

Read MoreGogo has announced financial results for the quarter ended 30 September 2021. "Demand for business aviation connectivity is surging and we expect it to continue to surge for the next...

Read More

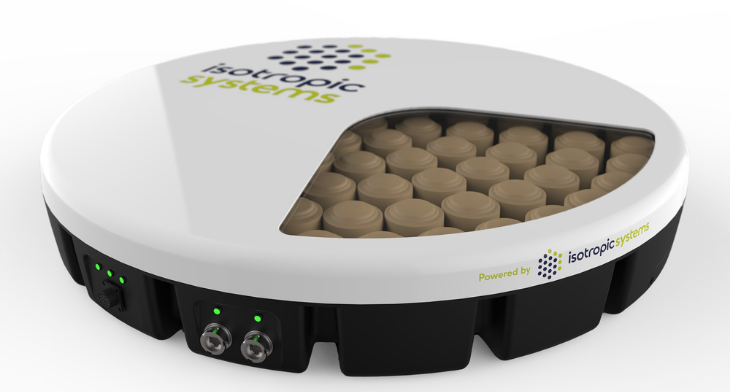

Isotropic Systems has raised over US$37 million in an equity financing round, which fully funds the development of its game-changing multi-link antennas through to product launch in 2022. The round...

Read More

Fintech business Centtrip has partnered with Adyen to launch its platform, app, and card in the US, with a particular focus on the private and business aviation industry. The Centtrip...

Read More

Eutelsat Communications has closed its US$550 million equity investment in OneWeb, giving it a 17.6% stake. Rodolphe Belmer, Chief Executive Officer of Eutelsat, said: “We are delighted to close this investment...

Read More

Key creditor groups of Intelsat have agreed to vote in favour of a comprehensive financial restructuring that would reduce the Company’s debt by more than half – from nearly US$15...

Read MoreAstronics has reported financial results for the three and six months ended 3 July 2021. Peter J. Gundermann, President and CEO, commented: “Our second quarter was one of slow but...

Read MoreViasat has revealed record Q1 fiscal year 2022. Satellite Services revenue increased to US$274 million, a 36% increase YoY. Gains were partially driven by improving in-flight connectivity (IFC) service revenues...

Read MoreGogo has released its financial results for the quarter ended 30 June 2021. The company achieved total revenue of US$82.4 million, an increase of 51% compared to Q2 2020 and...

Read More